Home " Oplossingen " Supply Chain Finance " Dynamic Discounting " Dynamic Discounting voor kopers

Gerelateerde inhoud

Nuttige bronnen

Unlock cash flow and strengthen supplier relationships

Managing cash flow and supplier relationships can be difficult for buyers, especially when relying on manual processes. Companies struggle to balance accounts payable and receivable, negotiate discounts, and handle supplier payments. Rising costs and an increasing number of discount requests can add pressure.

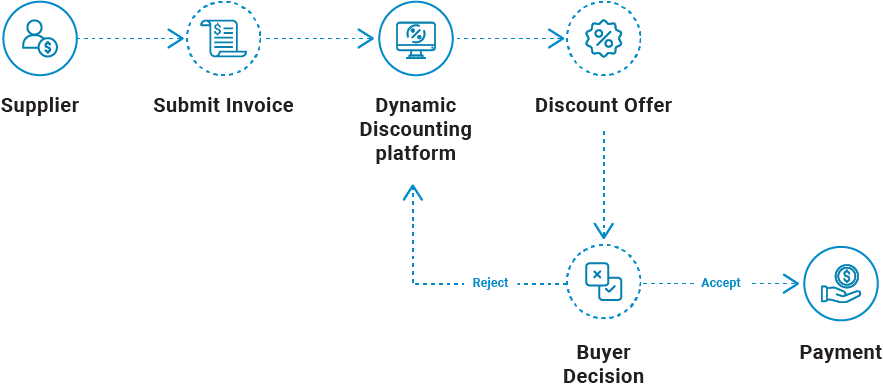

B2BE’s Dynamic Discounting solution solves these problems by automating negotiations, improving cash flow, and making it easier to work with suppliers. This helps buyers save time and reduce costs.

Dynamic Discounting enables buyers and suppliers to collaborate on early payment discounts. This makes communication efficient and seamless.

Buyer challenges solved with Dynamic Discounting

Unbalanced AP/AR Working Capital Tools

Balancing working capital across AP and AR can be difficult when the processes are not well-synchronised. Without a unified approach, companies may experience disruptions in cash flow, which affects their ability to meet financial objectives.

High Headcount Costs for Supplier Negotiations

As businesses grow, manually scaling supplier negotiations becomes more complex and expensive. The time and effort required for negotiation can lead to higher headcount costs, limiting a company’s ability to manage supplier relationships effectively.

Rising Raw Material Costs

With increasing raw material costs, there is a constant need to explore savings. Teams tasked with purchasing face pressure to secure discounts from suppliers, but without proper tools, it becomes difficult to reduce costs while maintaining cash flow stability.

Increasing Supplier Discount Requests

Handling a growing volume of discount requests from suppliers can strain existing processes. If these requests aren’t efficiently managed, they can lead to miscommunications, strained relationships, and disruptions in supply chain operations.

Manual Processes Leading to Time-Consuming and Error-Prone Workflows

Manual discounting processes are prone to errors and can slow down business operations. The time spent on calculations and approvals increases the risk of mistakes, delays, and payment inaccuracies, all of which can negatively impact business performance.

Key features of B2BE's Dynamic Discounting solution for buyers

Supplier Selection and Discount Requests

Buyers can easily identify suppliers eligible for discounts and make discount requests on outstanding invoices, streamlining the selection process and maximising cost-saving opportunities.

Automated Negotiation

The solution automates negotiations by allowing buyers and suppliers to exchange counter-offers and finalise terms, reducing negotiation time and ensuring both parties reach an agreement quickly and efficiently.

Invoice Data Synchronisation

Once discount terms are agreed upon, the newly negotiated invoice data is automatically sent back to the buyer, ensuring that payment schedules and discount details are accurately reflected.

Bank Payment Integration

The system integrates with the buyer’s bank, enabling accurate execution of new payment dates based on the negotiated discounts, reducing the risk of errors and late payments.

Simulation and Data Analytics

The platform provides the ability to simulate discount offerings, allowing buyers to evaluate potential savings and optimize their payment strategies before finalizing agreements with suppliers.

What you can achieve as a buyer with B2BE's Dynamic Discounting solution

Improvement on Financial Statements

Dynamic Discounting directly impacts key areas of your financial statements, such as cash flow, profit and loss, and the balance sheet. By taking advantage of early payment discounts, buyers can improve their cash position, reduce liabilities, and enhance overall profitability.

Overall Reduction of Cost of Goods Sold (COGS)

By strategically applying early payment discounts, buyers can significantly reduce their cost of goods sold (COGS). These discounts provide immediate savings, which directly improve profit margins.

Better Operation Cost Management

The automation of discount negotiations and payment processing reduces the reliance on manual labour, which means fewer staff are needed to handle complex invoice management tasks. This leads to lower operational costs, allowing businesses to run leaner without sacrificing efficiency.

Ability to Support Your Suppliers in Need

Dynamic Discounting not only benefits buyers but also strengthens relationships with suppliers. Offering early payments can provide much-needed liquidity to suppliers, especially those facing financial challenges. This support helps ensure the stability of your supply chain while fostering long-term partnerships built on trust and reliability.

Lower Administrative Costs

Automating the discounting process minimizes manual data entry and paperwork, significantly reducing the chance of human error. This leads to fewer mistakes in payment and discount applications, cutting down on costly administrative tasks. As a result, businesses experience greater operational efficiency, lowering overall administrative costs while improving accuracy.

Dynamic Discounting - ROI-berekenaar voor kopers

Gebruik de B2BE Calculator om te zien hoeveel winst (waarde of APR%) kan worden behaald als jouw organisatie dynamische kortingen implementeert met onze oplossing.